AAT Level 4 Diploma in Professional Accounting (Q2022)

97.2%

97.2%

- SALE Savings End Midnight Wednesday 30th April

- SALE Savings End Midnight Wednesday 30th April

AAT Level 4 Diploma in Professional Accounting (Q2022)

Key Points

- Helps you progress to senior accounting roles

- Achieve professional MAAT status

- Develop specialist accounting knowledge

- Master internal accounting systems and controls

- Complete possible in 12 months

- Internationally recognised AAT qualification

Studying Your Professional Diploma

If you want to reach the top of your game as an accounting professional, this Level 4 Diploma in Professional Accounting is for you.

As the most advanced accounting qualification offered by the AAT, it’s directly aimed at Accountants looking to achieve full AAT membership and professional MAAT status.

Through a range of advanced and specialist modules, you will learn to tackle challenging accounting topics and position yourself for senior finance roles.

You’ll learn about more complex accounting theory, how to expertly draft financial statements for limited companies and recommend strategies around accounting systems.

In addition to the mandatory units, you will also choose two of five subjects to specialise in:

- Business Tax

- Personal Tax

- Audit and Assurance

- Cash and Financial Management

- Credit and Debt Management

As the course is also completely online, you can study at home whenever suits you. Minimising the disruption to your life while you get ready for the next phase of your career.

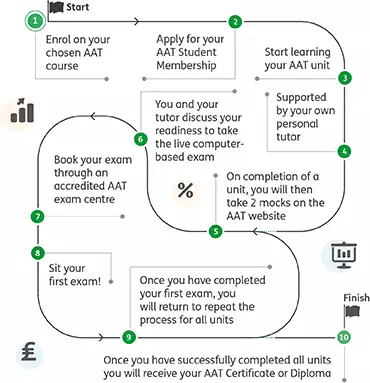

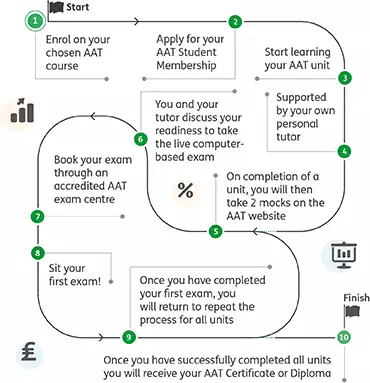

Your 10 Step AAT Learner Journey

Your Career with AAT

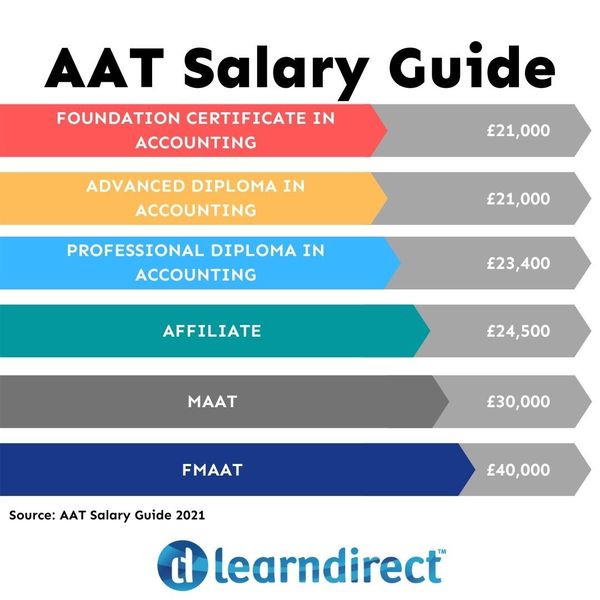

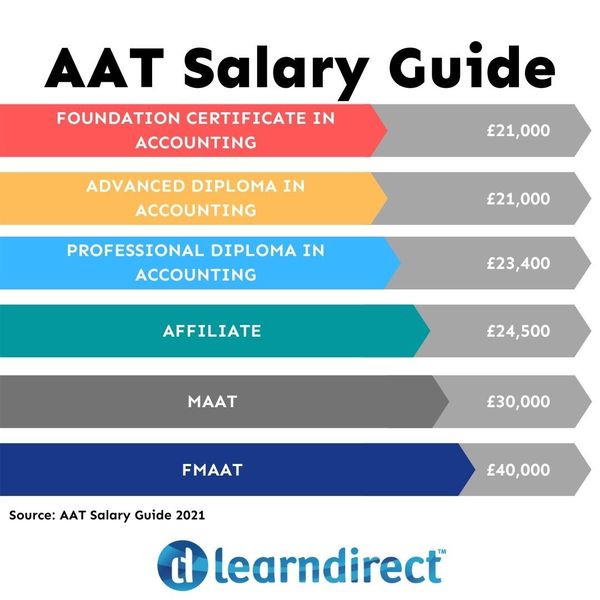

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Getting Started

learndirect is a leading UK distance learning provider. This Professional Diploma in Accounting is awarded and accredited by The Association of Accounting Technicians (AAT). With help of industry leaders and professionals, you will learn the professional knowledge and skills to excel in real life financial industry scenarios.

Distance learning puts you in control, giving you the flexibility to determine when and where you will study. With all the course materials and dedicated tutor assistance accessible online, there is no need for you to set foot in a classroom.

This course can be completed in as little as nine months. With the only deadlines being your exams, completion time will depend on when you enrol.

Achieve the qualification that gives you professional MAAT status, sets you on the path to high paying financial positions and provides the opportunity to study as a Chartered Accountant.

Additional Fees

As part of your studies, you will need to be a student member of the AAT. You can complete this quickly and easily with AAT by clicking here.

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 3 mandatory units, and 2 specialist units.

The mandatory units are:

Unit 1: Applied Management Accounting

On completion of this unit, you will:

- Understand and implement the organisational planning process

- Use internal processes to enhance operational control

- Use techniques to aid short-term and long-term decision making

- Analyse and report on business performance

Unit 2: Drafting and Interpreting Financial Statements

On completion of this unit, you will:

- Understand the reporting frameworks that underpin financial reporting

- Draft statutory financial statements for limited companies

- Draft consolidated financial statements

- Interpret financial statements using ratio analysis

Unit 3: Internal Accounting Systems and Controls

On completion of this unit, you will:

- Understand the role and responsibilities of the accounting function within an organisation

- Evaluate internal control systems

- Evaluate an organisation’s accounting system and underpinning procedures

- Understand the impact of technology on accounting systems

- Recommend improvements to an organisation’s accounting system

The specialist units are:

Business Tax

On completion of this unit, you will:

- Prepare tax computations for sole traders and partnerships

- Prepare tax computations for limited companies

- Prepare tax computations for the sale of capital assets by limited companies

- Understand administrative requirements of the UK’s tax regime

- Understand the tax implications of business disposals

- Understand tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs

Personal Tax

On completion of this unit, you will:

- Understand principles and rules that underpin taxation systems

- Calculate a UK taxpayer’s total income

- Calculate income tax and National Insurance (NI) contributions payable by a UK taxpayer

- Calculate capital gains tax payable by UK taxpayers

- Understand the principles of inheritance tax

Audit and Assurance

On completion of this unit, you will:

- Demonstrate an understanding of the audit and assurance framework

- Demonstrate the importance of professional ethics

- Evaluate the planning process for audit and assurance

- Evaluate procedures for obtaining sufficient and appropriate evidence

- Review and report findings

Cash and Financial Management

On completion of this unit, you will:

- Prepare forecasts for cash receipts and payments

- Prepare cash budgets and monitor cash flows

- Understand the importance of managing finance and liquidity

- Understand ways of raising finance and investing funds

- Understand regulations and organisational policies that influence decisions in managing cash and finance

Credit and Debt Management

On completion of this unit, you will:

- Understand relevant legislation and contract law that impacts the credit control environment

- Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures

- Understand the organisation’s credit control processes for managing and collecting debts

- Understand different techniques available to collect debt

Entry Requirements

You must already have successfully completed the AAT Level 3 Accounting course to enrol.

Minimum Age restriction

You must be aged 18 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 14-18 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 5 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £66.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £251 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider. You will need to check with your training provider as to the availability and schedule for completing your assessments.

Fees

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

AAT

Upon successful completion of this course, you will be awarded the AAT Level 4 Diploma in Professional Accounting (Qualification Number: 603/6339/3)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Professional Diploma in Accounting Level 4 you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

- SALE Savings End Midnight Wednesday 30th April

- SALE Savings End Midnight Wednesday 30th April

AAT Level 4 Diploma in Professional Accounting (Q2022)

Key Points

- Helps you progress to senior accounting roles

- Achieve professional MAAT status

- Develop specialist accounting knowledge

- Master internal accounting systems and controls

- Complete possible in 12 months

- Internationally recognised AAT qualification

Studying Your Professional Diploma

If you want to reach the top of your game as an accounting professional, this Level 4 Diploma in Professional Accounting is for you.

As the most advanced accounting qualification offered by the AAT, it’s directly aimed at Accountants looking to achieve full AAT membership and professional MAAT status.

Through a range of advanced and specialist modules, you will learn to tackle challenging accounting topics and position yourself for senior finance roles.

You’ll learn about more complex accounting theory, how to expertly draft financial statements for limited companies and recommend strategies around accounting systems.

In addition to the mandatory units, you will also choose two of five subjects to specialise in:

- Business Tax

- Personal Tax

- Audit and Assurance

- Cash and Financial Management

- Credit and Debt Management

As the course is also completely online, you can study at home whenever suits you. Minimising the disruption to your life while you get ready for the next phase of your career.

Your 10 Step AAT Learner Journey

Your Career with AAT

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Getting Started

learndirect is a leading UK distance learning provider. This Professional Diploma in Accounting is awarded and accredited by The Association of Accounting Technicians (AAT). With help of industry leaders and professionals, you will learn the professional knowledge and skills to excel in real life financial industry scenarios.

Distance learning puts you in control, giving you the flexibility to determine when and where you will study. With all the course materials and dedicated tutor assistance accessible online, there is no need for you to set foot in a classroom.

This course can be completed in as little as nine months. With the only deadlines being your exams, completion time will depend on when you enrol.

Achieve the qualification that gives you professional MAAT status, sets you on the path to high paying financial positions and provides the opportunity to study as a Chartered Accountant.

Additional Fees

As part of your studies, you will need to be a student member of the AAT. You can complete this quickly and easily with AAT by clicking here.

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following link.

Modules

This course comprises of 3 mandatory units, and 2 specialist units.

The mandatory units are:

Unit 1: Applied Management Accounting

On completion of this unit, you will:

- Understand and implement the organisational planning process

- Use internal processes to enhance operational control

- Use techniques to aid short-term and long-term decision making

- Analyse and report on business performance

Unit 2: Drafting and Interpreting Financial Statements

On completion of this unit, you will:

- Understand the reporting frameworks that underpin financial reporting

- Draft statutory financial statements for limited companies

- Draft consolidated financial statements

- Interpret financial statements using ratio analysis

Unit 3: Internal Accounting Systems and Controls

On completion of this unit, you will:

- Understand the role and responsibilities of the accounting function within an organisation

- Evaluate internal control systems

- Evaluate an organisation’s accounting system and underpinning procedures

- Understand the impact of technology on accounting systems

- Recommend improvements to an organisation’s accounting system

The specialist units are:

Business Tax

On completion of this unit, you will:

- Prepare tax computations for sole traders and partnerships

- Prepare tax computations for limited companies

- Prepare tax computations for the sale of capital assets by limited companies

- Understand administrative requirements of the UK’s tax regime

- Understand the tax implications of business disposals

- Understand tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs

Personal Tax

On completion of this unit, you will:

- Understand principles and rules that underpin taxation systems

- Calculate a UK taxpayer’s total income

- Calculate income tax and National Insurance (NI) contributions payable by a UK taxpayer

- Calculate capital gains tax payable by UK taxpayers

- Understand the principles of inheritance tax

Audit and Assurance

On completion of this unit, you will:

- Demonstrate an understanding of the audit and assurance framework

- Demonstrate the importance of professional ethics

- Evaluate the planning process for audit and assurance

- Evaluate procedures for obtaining sufficient and appropriate evidence

- Review and report findings

Cash and Financial Management

On completion of this unit, you will:

- Prepare forecasts for cash receipts and payments

- Prepare cash budgets and monitor cash flows

- Understand the importance of managing finance and liquidity

- Understand ways of raising finance and investing funds

- Understand regulations and organisational policies that influence decisions in managing cash and finance

Credit and Debt Management

On completion of this unit, you will:

- Understand relevant legislation and contract law that impacts the credit control environment

- Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures

- Understand the organisation’s credit control processes for managing and collecting debts

- Understand different techniques available to collect debt

Entry Requirements

You must already have successfully completed the AAT Level 3 Accounting course to enrol.

Minimum Age restriction

You must be aged 18 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 14-18 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 5 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £66.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £251 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

Assessment

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider. You will need to check with your training provider as to the availability and schedule for completing your assessments.

Fees

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

Qualifications

AAT

Upon successful completion of this course, you will be awarded the AAT Level 4 Diploma in Professional Accounting (Qualification Number: 603/6339/3)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

The Association of Accounting Technicians (AAT) is a world-renowned professional body of Accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Professional Diploma in Accounting Level 4 you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

97.2%

97.2%

learning

learning hours

If you find this course cheaper anywhere

If you find this course cheaper anywhere