AAT Level 2 3 4 Combined: Become an Expert Accountant

97.2%

97.2%

- SALE Savings End Midnight Tuesday 23rd December

- SALE Savings End Midnight Tuesday 23rd December

AAT Level 2 Certificate, Level 3 and Level 4 Diploma in Professional Accounting Combined (Q2022)

Key Points

- Go from a novice to an expert Accountant

- Gives you all the knowledge and skills required for an accounting career

- Readies you for complex accounting challenges

- Provides you with nationally recognised qualifications

- Helps you achieve professional MAAT status

- 100% online

About Your AAT Bundle

If you want to enter the accounting profession and climb to the top of the ladder quickly, this comprehensive accounting course bundle is for you.

Designed for those with no prior experience, you can enrol on this course so long as you have a head for numbers and a desire to learn.

Each section will develop your knowledge and build on the last to make sure you’re job-ready on completion. Teaching you everything you need to know from maintaining accurate financial records and managing budgets, to taxation and financial statements.

The Level 2 Certificate in Accounting begins with the exploration of business finances, sales invoices, and budgets. So you become equipped with the foundation skills and understanding you need to enter the job market as an Accountant.

From here, the Level 3 Diploma in Accounting builds on this knowledge by covering the management of accounting costs, ethics, VAT and advanced accounting.

The Level 4 Professional Accounting online course then advances your understanding by tackling higher-level accounting and finance topics. You will learn all about accounting systems strategies and how to create and present complex management accounting reports, all with the aim of preparing you for senior business operations.

In addition to this, the course bundle helps you become proficient in specialist areas like tax, auditing and assurance, credit and debt management, cash and financial management.

Completing this array of online courses will enable you to achieve professional MAAT status, making you very desirable to potential employers. The qualifications provided will also allow you to apply for senior accounting roles such as Financial Analyst or Tax Manager.

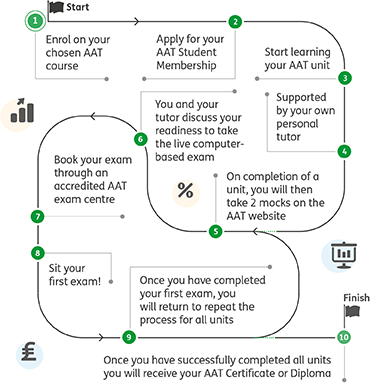

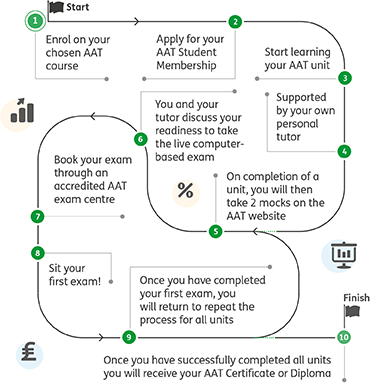

Your 10 Step AAT Learner Journey

Your Career with AAT

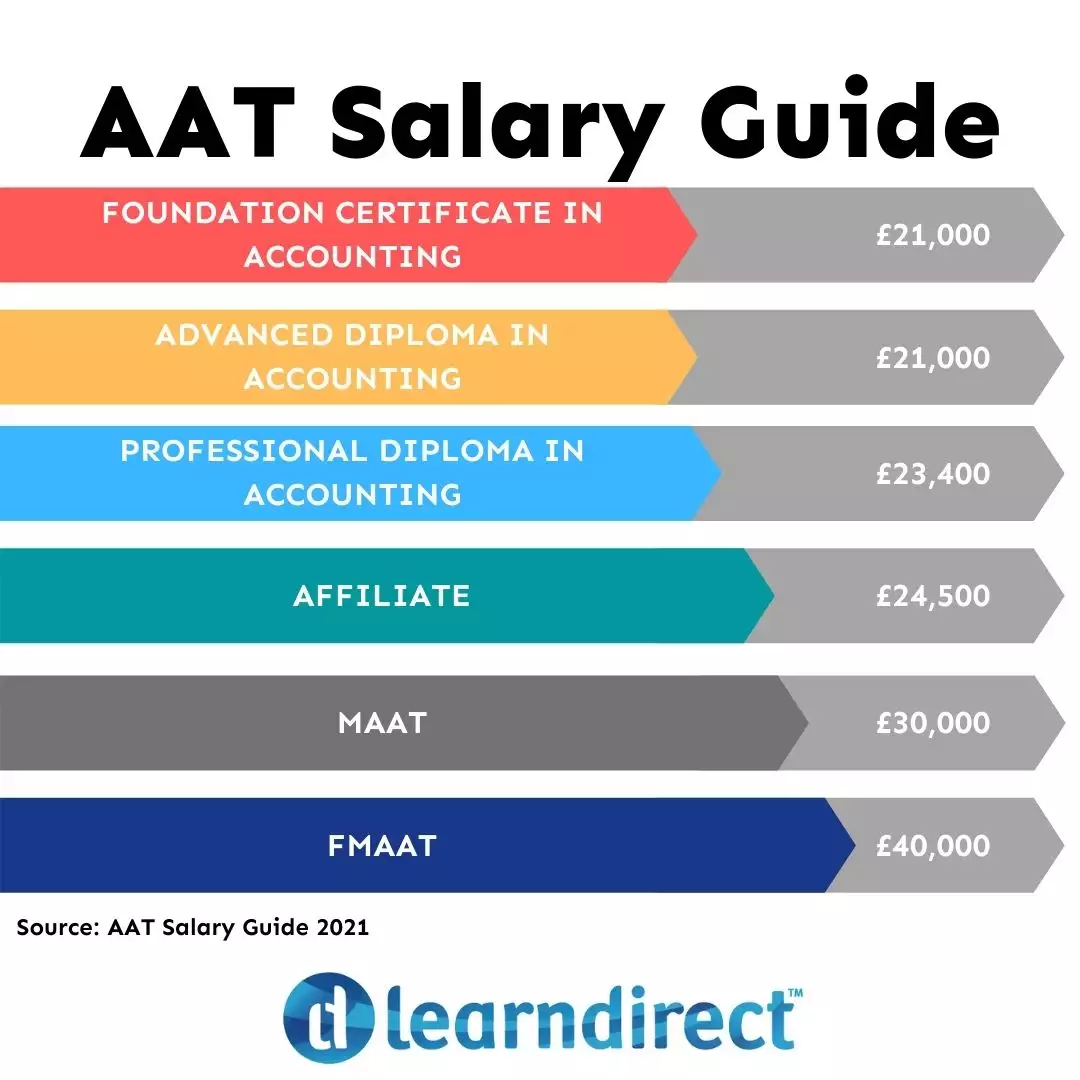

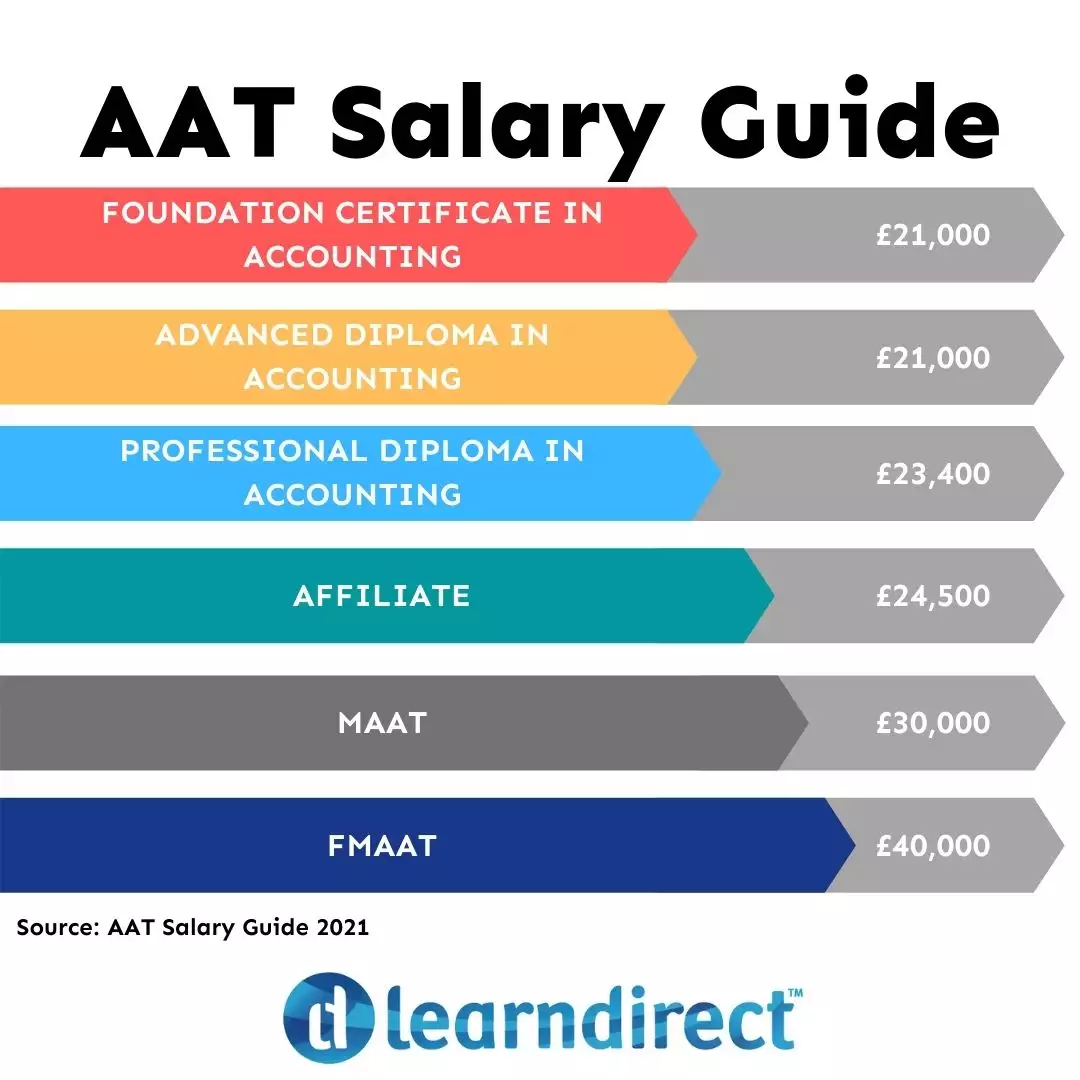

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Getting Started

This vocational online course bundle will give you the knowledge and qualifications you need to progress your career in accounting.

All three courses are accredited by the Association of Accounting Technicians (AAT). In collaboration with industry leaders and professionals, the online courses give you advanced knowledge and skills based on real world financial contexts.

As a fully online college, there is no need for you to attend classes. You can structure your learning around your circumstances and set your own timetable.

Besides your exams, there are no deadlines. This allows you to work through the course materials quickly, reaching your qualification sooner than you would in a structured classroom setting.

Take your accounting skills to the next level and position yourself as a highly employable candidate in the financial sector.

Additional Fees

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following links: Level 2, Level 3 & Level 4.

Modules

AAT Level 2 Certificate in Accounting Modules

This course comprises of 4 mandatory units.

Unit 1: Introduction to Bookkeeping

On completion of this unit, you will:

- Understand how to set up bookkeeping systems

- Process customer transactions

- Process supplier transactions

- Process receipts and payments

- Process transactions into the ledger accounts

Unit 2: Principles of Bookkeeping Controls

On completion of this unit, you will:

- Use control accounts

- Reconcile a bank statement with the cash book

- Use the journal

- Produce trial balances

Unit 3: Principles of Costing

On completion of this unit, you will:

- Understand the cost recording system within an organisation

- Use cost recording techniques

- Provide information on actual and budgeted costs and income

- Use tools and techniques to support cost calculations

Unit 4: The Business Environment (Synoptic Assessment)

On completion of this unit, you will:

- Understand the principles of contract law

- Understand the external business environment

- Understand key principles of corporate social responsibility (CSR), ethics and sustainability

- Understand the impact of setting up different types of business entity

- Understand the finance function within an organisation

- Produce work in appropriate formats and communicate effectively

- Understand the importance of information to business operations

AAT Level 3 Diploma in Accounting Modules

This course comprises of 4 Mandatory units.

Unit 1: Business Awareness

On completion of this unit, you will:

- Understand business types, structures and governance, and the legal framework in which they operate

- Understand the impact of the external and internal environment on businesses, their performance, and decisions

- Understand how businesses and accountants comply with principles of professional ethics

- Understand the impact of new technologies in accounting and the risks associated with data security

- Communicate information to stakeholders

Unit 2: Financial Accounting; Preparing Financial Statements

On completion of this unit, you will:

- Understand the accounting principles underlying final accounts preparation

- Understand the principles of advanced double-entry bookkeeping

- Implement procedures for the acquisition and disposal of non-current assets

- Prepare and record depreciation calculations

- Produce and extend the trial balance

- Produce financial statements for sole traders and partnerships

- Interpret financial statements using profitability ratios

- Prepare accounting records from incomplete information

Unit 3: Management Accounting Techniques

On completion of this unit, you will:

- Understand the purpose and use of management accounting within organisations

- Use techniques required for dealing with costs

- Attribute costs according to organisational requirements

- Investigate deviations from budgets

- Use spreadsheet techniques to provide management accounting information

- Use management accounting techniques to support short-term decision making

- Understand principles of cash management

Unit 4: Tax Processes for Business

On completion of this unit, you will:

- Understand and apply VAT legislation requirements

- Calculate VAT

- Review and verify VAT returns

- Understand principles of payroll

- Report information within the organisation

AAT Level 4 Diploma in Professional Accounting Modules

This course comprises of 3 mandatory units and 2 specialist units.

The mandatory units are:

Applied Management Accounting

On completion of this unit, you will:

- Understand and implement the organisational planning process

- Use internal processes to enhance operational control

- Use techniques to aid short-term and long-term decision making

- Analyse and report on business performance

Drafting and Interpreting Financial Statements

On completion of this unit, you will:

- Understand the reporting frameworks that underpin financial reporting

- Draft statutory financial statements for limited companies

- Draft consolidated financial statements

- Interpret financial statements using ratio analysis

Internal Accounting Systems and Controls

On completion of this unit, you will:

- Understand the role and responsibilities of the accounting function within an organisation

- Evaluate internal control systems

- Evaluate an organisation’s accounting system and underpinning procedures

- Understand the impact of technology on accounting systems

- Recommend improvements to an organisation’s accounting system

The specialist units are:

Business Tax

On completion of this unit, you will:

- Prepare tax computations for sole traders and partnerships

- Prepare tax computations for limited companies

- Prepare tax computations for the sale of capital assets by limited companies

- Understand administrative requirements of the UK’s tax regime

- Understand the tax implications of business disposals

- Understand tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs

Personal Tax

On completion of this unit, you will:

- Understand principles and rules that underpin taxation systems

- Calculate a UK taxpayer’s total income

- Calculate income tax and National Insurance (NI) contributions payable by a UK taxpayer

- Calculate capital gains tax payable by UK taxpayers

- Understand the principles of inheritance tax

Audit and Assurance

On completion of this unit, you will:

- Demonstrate an understanding of the audit and assurance framework

- Demonstrate the importance of professional ethics

- Evaluate the planning process for audit and assurance

- Evaluate procedures for obtaining sufficient and appropriate evidence

- Review and report findings

Cash and Financial Management

On completion of this unit, you will:

- Prepare forecasts for cash receipts and payments

- Prepare cash budgets and monitor cash flows

- Understand the importance of managing finance and liquidity

- Understand ways of raising finance and investing funds

- Understand regulations and organisational policies that influence decisions in managing cash and finance

Credit and Debt Management

On completion of this unit, you will:

- Understand relevant legislation and contract law that impacts the credit control environment

- Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures

- Understand the organisation’s credit control processes for managing and collecting debts

- Understand different techniques available to collect debt

Entry Requirements

There are no entry requirements for this course, it is open to all.

Minimum Age restriction

You must be aged 18 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 14-18 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 5 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £90/£120.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £245 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider. You will need to check with your training provider as to the availability and schedule for completing your assessments.

Fees

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

AAT

Upon successful completion of this course, you will be awarded:

- AAT Level 2 Certificate in Accounting (Qualification Number: 603/6338/1)

- AAT Level 3 Diploma in Accounting (Qualification Number: 603/6337/X)

- AAT Level 4 Diploma in Professional Accounting (Qualification Number: 603/6339/3)

The AAT Professional Diploma in Accounting can give qualified students exemptions towards all or parts of the UK’s chartered and certified accountancy qualifications. The following chartered bodies offer exemptions to AAT students:

- The Chartered Institute of Public Finance and Accountancy (CIPFA)

- The Institute of Chartered Accountants in England and Wales (ICAEW)

- The Association of Chartered Certified Accountants (ACCA)

- The Chartered Institute of Management Accountants (CIMA)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

Career

The Association of Accounting Technicians (AAT) is a world-renowned professional body of accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Frequently Asked Questions

- SALE Savings End Midnight Tuesday 23rd December

- SALE Savings End Midnight Tuesday 23rd December

AAT Level 2 Certificate, Level 3 and Level 4 Diploma in Professional Accounting Combined (Q2022)

Key Points

- Go from a novice to an expert Accountant

- Gives you all the knowledge and skills required for an accounting career

- Readies you for complex accounting challenges

- Provides you with nationally recognised qualifications

- Helps you achieve professional MAAT status

- 100% online

About Your AAT Bundle

If you want to enter the accounting profession and climb to the top of the ladder quickly, this comprehensive accounting course bundle is for you.

Designed for those with no prior experience, you can enrol on this course so long as you have a head for numbers and a desire to learn.

Each section will develop your knowledge and build on the last to make sure you’re job-ready on completion. Teaching you everything you need to know from maintaining accurate financial records and managing budgets, to taxation and financial statements.

The Level 2 Certificate in Accounting begins with the exploration of business finances, sales invoices, and budgets. So you become equipped with the foundation skills and understanding you need to enter the job market as an Accountant.

From here, the Level 3 Diploma in Accounting builds on this knowledge by covering the management of accounting costs, ethics, VAT and advanced accounting.

The Level 4 Professional Accounting online course then advances your understanding by tackling higher-level accounting and finance topics. You will learn all about accounting systems strategies and how to create and present complex management accounting reports, all with the aim of preparing you for senior business operations.

In addition to this, the course bundle helps you become proficient in specialist areas like tax, auditing and assurance, credit and debt management, cash and financial management.

Completing this array of online courses will enable you to achieve professional MAAT status, making you very desirable to potential employers. The qualifications provided will also allow you to apply for senior accounting roles such as Financial Analyst or Tax Manager.

Your 10 Step AAT Learner Journey

Your Career with AAT

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Getting Started

This vocational online course bundle will give you the knowledge and qualifications you need to progress your career in accounting.

All three courses are accredited by the Association of Accounting Technicians (AAT). In collaboration with industry leaders and professionals, the online courses give you advanced knowledge and skills based on real world financial contexts.

As a fully online college, there is no need for you to attend classes. You can structure your learning around your circumstances and set your own timetable.

Besides your exams, there are no deadlines. This allows you to work through the course materials quickly, reaching your qualification sooner than you would in a structured classroom setting.

Take your accounting skills to the next level and position yourself as a highly employable candidate in the financial sector.

Additional Fees

All computer-based examinations are completed at an AAT-approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams will cost approximately £90-£120 per exam depending on the exam centre that you choose and are not included in the course fees.

AAT Remote Invigilation

AAT remote invigilation for Q2022 is available to book on the following links: Level 2, Level 3 & Level 4.

Modules

AAT Level 2 Certificate in Accounting Modules

This course comprises of 4 mandatory units.

Unit 1: Introduction to Bookkeeping

On completion of this unit, you will:

- Understand how to set up bookkeeping systems

- Process customer transactions

- Process supplier transactions

- Process receipts and payments

- Process transactions into the ledger accounts

Unit 2: Principles of Bookkeeping Controls

On completion of this unit, you will:

- Use control accounts

- Reconcile a bank statement with the cash book

- Use the journal

- Produce trial balances

Unit 3: Principles of Costing

On completion of this unit, you will:

- Understand the cost recording system within an organisation

- Use cost recording techniques

- Provide information on actual and budgeted costs and income

- Use tools and techniques to support cost calculations

Unit 4: The Business Environment (Synoptic Assessment)

On completion of this unit, you will:

- Understand the principles of contract law

- Understand the external business environment

- Understand key principles of corporate social responsibility (CSR), ethics and sustainability

- Understand the impact of setting up different types of business entity

- Understand the finance function within an organisation

- Produce work in appropriate formats and communicate effectively

- Understand the importance of information to business operations

AAT Level 3 Diploma in Accounting Modules

This course comprises of 4 Mandatory units.

Unit 1: Business Awareness

On completion of this unit, you will:

- Understand business types, structures and governance, and the legal framework in which they operate

- Understand the impact of the external and internal environment on businesses, their performance, and decisions

- Understand how businesses and accountants comply with principles of professional ethics

- Understand the impact of new technologies in accounting and the risks associated with data security

- Communicate information to stakeholders

Unit 2: Financial Accounting; Preparing Financial Statements

On completion of this unit, you will:

- Understand the accounting principles underlying final accounts preparation

- Understand the principles of advanced double-entry bookkeeping

- Implement procedures for the acquisition and disposal of non-current assets

- Prepare and record depreciation calculations

- Produce and extend the trial balance

- Produce financial statements for sole traders and partnerships

- Interpret financial statements using profitability ratios

- Prepare accounting records from incomplete information

Unit 3: Management Accounting Techniques

On completion of this unit, you will:

- Understand the purpose and use of management accounting within organisations

- Use techniques required for dealing with costs

- Attribute costs according to organisational requirements

- Investigate deviations from budgets

- Use spreadsheet techniques to provide management accounting information

- Use management accounting techniques to support short-term decision making

- Understand principles of cash management

Unit 4: Tax Processes for Business

On completion of this unit, you will:

- Understand and apply VAT legislation requirements

- Calculate VAT

- Review and verify VAT returns

- Understand principles of payroll

- Report information within the organisation

AAT Level 4 Diploma in Professional Accounting Modules

This course comprises of 3 mandatory units and 2 specialist units.

The mandatory units are:

Applied Management Accounting

On completion of this unit, you will:

- Understand and implement the organisational planning process

- Use internal processes to enhance operational control

- Use techniques to aid short-term and long-term decision making

- Analyse and report on business performance

Drafting and Interpreting Financial Statements

On completion of this unit, you will:

- Understand the reporting frameworks that underpin financial reporting

- Draft statutory financial statements for limited companies

- Draft consolidated financial statements

- Interpret financial statements using ratio analysis

Internal Accounting Systems and Controls

On completion of this unit, you will:

- Understand the role and responsibilities of the accounting function within an organisation

- Evaluate internal control systems

- Evaluate an organisation’s accounting system and underpinning procedures

- Understand the impact of technology on accounting systems

- Recommend improvements to an organisation’s accounting system

The specialist units are:

Business Tax

On completion of this unit, you will:

- Prepare tax computations for sole traders and partnerships

- Prepare tax computations for limited companies

- Prepare tax computations for the sale of capital assets by limited companies

- Understand administrative requirements of the UK’s tax regime

- Understand the tax implications of business disposals

- Understand tax reliefs, tax planning opportunities and agent’s responsibilities in reporting taxation to HM Revenue & Customs

Personal Tax

On completion of this unit, you will:

- Understand principles and rules that underpin taxation systems

- Calculate a UK taxpayer’s total income

- Calculate income tax and National Insurance (NI) contributions payable by a UK taxpayer

- Calculate capital gains tax payable by UK taxpayers

- Understand the principles of inheritance tax

Audit and Assurance

On completion of this unit, you will:

- Demonstrate an understanding of the audit and assurance framework

- Demonstrate the importance of professional ethics

- Evaluate the planning process for audit and assurance

- Evaluate procedures for obtaining sufficient and appropriate evidence

- Review and report findings

Cash and Financial Management

On completion of this unit, you will:

- Prepare forecasts for cash receipts and payments

- Prepare cash budgets and monitor cash flows

- Understand the importance of managing finance and liquidity

- Understand ways of raising finance and investing funds

- Understand regulations and organisational policies that influence decisions in managing cash and finance

Credit and Debt Management

On completion of this unit, you will:

- Understand relevant legislation and contract law that impacts the credit control environment

- Understand how information is used to assess credit risk and grant credit in compliance with organisational policies and procedures

- Understand the organisation’s credit control processes for managing and collecting debts

- Understand different techniques available to collect debt

Entry Requirements

There are no entry requirements for this course, it is open to all.

Minimum Age restriction

You must be aged 18 or above to enrol on this course.

Average completion timeframe

The average time it takes to complete the course is 14-18 months.

Assessment requirements

All units in each qualification will be assessed by AAT Official CBE's (Computer Based Exams).

Exams required

Learners will undergo 5 exams, which will need to be paid for separately as they are not included as part of the course fee. Each exam costs approximately £90/£120.

Is Membership Required?

Membership is required and must be paid by the learner separately. Please see additional requirements for the exact fee.

Additional requirements

You will need a computer or laptop to study the course, and you must secure AAT Membership within 4 weeks of starting the course. Please note that the AAT Membership fee of £245 is not included in the course fee. If you are unsure of what level of qualification is best for you, then take the AAT Skillcheck (link to https://www.aat.org.uk/qualifications-and-courses/skillcheck) Test to find out.

Certification Timeframe

It can take approximately 6 months for your certification to be delivered, but all queries must be directed to AAT student services.

Course Fees

All course fees, inclusive of all payment plans including our Premium Credit Limited option, must be settled before the final unit will be available.

*You will have access to the course for 24 months.

Assessment

When studying for an AAT qualification, your knowledge and skills will be tested via computer-based assessments (CBAs). These are administered by AAT training providers or assessment centres and run entirely on PCs or laptops.

Computer-Based Assessments

AAT’s computer-based assessments are marked in one of three ways:

- Wholly computer marked, and so results will be available automatically

- Partially computer marked and partially human marked, and so results will be available within six weeks

- Wholly human marked, and so results will be available within six weeks

When are you assessed?

You will sit assessments when you are ready, as agreed with your training provider. You will need to check with your training provider as to the availability and schedule for completing your assessments.

Fees

Computer-based exams are taken under invigilated conditions at an AAT approved external exam centre. You will discuss this further with your dedicated tutor during your studies, but unit computer-based exams cost approximately £90-£120 per exam and are not included in your course fees.

Qualifications

AAT

Upon successful completion of this course, you will be awarded:

- AAT Level 2 Certificate in Accounting (Qualification Number: 603/6338/1)

- AAT Level 3 Diploma in Accounting (Qualification Number: 603/6337/X)

- AAT Level 4 Diploma in Professional Accounting (Qualification Number: 603/6339/3)

The AAT Professional Diploma in Accounting can give qualified students exemptions towards all or parts of the UK’s chartered and certified accountancy qualifications. The following chartered bodies offer exemptions to AAT students:

- The Chartered Institute of Public Finance and Accountancy (CIPFA)

- The Institute of Chartered Accountants in England and Wales (ICAEW)

- The Association of Chartered Certified Accountants (ACCA)

- The Chartered Institute of Management Accountants (CIMA)

AAT works across the globe with around 140,000 members in more than 90 countries. Their members, including students, are represented at every level of the finance and accounting world.

AAT members are ambitious, focused accounting professionals. Many of AAT members occupy senior, well-rewarded positions with thousands of employers – from blue-chip corporate giants to public sector institutions.

AAT qualifications are universally respected and internationally recognised. Organisations hire AAT qualified members for their knowledge, skills, diligence and enthusiasm, because AAT represents the highest standards of professionalism. In short, an AAT qualification is a route to some of the most in-demand skills in the world, and provides their students and members with a professional status to be proud of.

Career

The Association of Accounting Technicians (AAT) is a world-renowned professional body of accountants with members across 90 countries. As such it is one of the most widely regarded and respected accounting bodies in the world.

Whether you have a small business or want to further your accounting or bookkeeping career, gaining an AAT accredited qualification will give you the skills you need to achieve your goal.

AAT accredited qualifications are also internationally recognised, opening career opportunities around the world, and allowing you to expand your financial horizons in diverse and exciting new ways.

Once you achieve the AAT Level 4 Diploma in Professional Accounting you should aim to apply for Accountant, or Senior Accountant roles with salaries ranging from £30,000 - £43,000 per year.

Frequently Asked Questions

97.2%

97.2%

learning

learning hours

If you find this course cheaper anywhere

If you find this course cheaper anywhere